Manuta

Sherwin-Williams (NYSE:SHW) manufactures paints and related products worldwide. SHW recently announced its Q3 FY23 results. I believe there isn't even one positive factor that will make me want to buy the company right now. The market conditions aren't favorable, its valuation is high, and the price action is weak. Hence, I assign a hold rating on SHW.

Financial Analysis

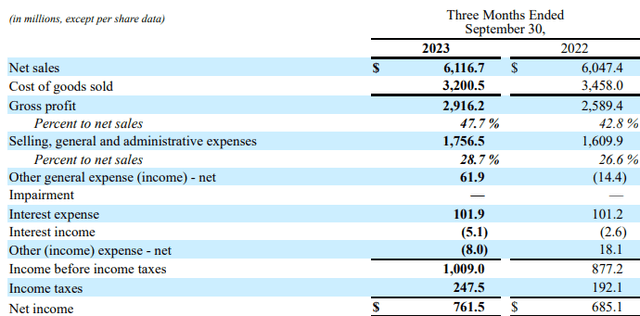

SHW recently announced its Q3 FY23 results. The sales for Q3 FY23 were $6.1 billion, a minimal rise of 1.1% compared to Q3 FY22. The reason for the stagnant sales growth was underperformance in its Consumer Brands Group [CBG] and Performance Coatings Group [PCG] segments. The sales from the CBG segment declined by 4% in Q3 FY23 compared to Q3 FY22. The sales from the CBG segment were affected by the divestment of its architectural business in China. The sales from the PCG segment declined by 1% in Q3 FY23 compared to Q3 FY22. A low demand in North America and Asia affected the PCG segment sales. The sales in North America were down mainly due to destocking issues. The gross profit margin for Q3 FY23 was 47.6%, which was 42.8% in Q3 FY22. The significant rise in gross margin was due to higher pricing and lower raw materials costs.

Seeking Alpha

Despite the minute rise in sales, the company was able to improve its profitability through its efficient management, which is impressive. Its net income in Q3 FY23 increased by 11.1% compared to Q3 FY22. The sales number might not look attractive, but I believe even the slight growth is impressive because the current market condition is quite difficult, and even experiencing growth in this market is commendable, especially since the housing market has taken a hit in both North America and Europe due to rising mortgage and interest rates. This housing market crisis is a matter of concern for the company because, till the time the slowdown continues, the company will continue to face a slowdown in its sales growth. So, until the market conditions are normal, I don't think they'll see steady expansion, and I believe that the financial results in the coming quarters might be volatile.

Technical Analysis

Trading View

SHW is trading at $236. SHW looks quite good for the long term, but in the short term, we might see a small fall in the stock price. After making a high of $354 in 2021, it went into a downtrend and started to form a lower high and lower low, which is a bearish pattern and might indicate a downtrend. However, after being in a downtrend for about two years, the stock has broken the structure and formed a higher high, which might be an indication of a trend reversal. So, the stock looks great for the long term, but in the short term, I see a downside of 6% from the current level because the stock is in the phase of forming a new structure of higher highs and higher lows. So, the next support zone for the stock is at $222, and I think the stock price might take support from the $222 level and complete the structure of higher high and higher low. Hence, I would advise waiting for the small correction, and when the stock reaches $222, one can add the stock for the long term.

Should One Invest In SHW?

I already mentioned that the coming quarters can be quite volatile in terms of financials. We might only see stability in the financial performance once the housing market is back on track, which I don't see happening in the first half of 2024. So, it would be wise to stay away from the company in the near term, and the technical chart indicates a small correction in the near term. So both these factors suggest that it would be wise to ignore it for now. Now, lastly, look at SHW's valuation. SHW is trading above its historical average and the sector median. SHW has a P/E [FWD] ratio of 25.71x, its five-year average P/E ratio is around 22.63x, and the sector median is around 14.63x. In addition, SHW has a PEG [TTM] ratio of 0.95x, which is higher than the sector ratio of 0.74x. So, its current valuation seems unattractive, and looking at its current growth and weak outlook, I don't think it would be able to sustain a high valuation. So, in my opinion, considering the weak outlook and all the uncertainties, it will be best to ignore it until the market conditions are favorable.

Risk

In 2022, 2021, and 2020, respectively, the net external sales of their consolidated overseas subsidiaries amounted to around 19.4%, 21.2%, and 19.5% of their total consolidated net sales. Their current business and future strategic goals largely revolve around sales outside the United States. "Numerous domestic and international factors, such as general economic conditions, inflation rates, recessions, tariffs, foreign currency exchange controls, interest rates, restrictions on foreign investment and repatriation, legal and regulatory constraints, challenges in staffing and managing foreign operations, and other economic and political factors," could hurt their "financial condition, cash flow, liquidity, or operational results". It is not unusual for people to participate in commercial tactics that are illegal in many other nations due to laws that apply to them, such as the U.K. Bribery Act and the other Corrupt Tactics Act. Anti-bribery law enforcement activity has significantly increased in recent years, with both U.S. and non-U.S. regulators conducting more regular and vigorous investigations and enforcement actions, as well as filing more criminal and civil lawsuits against businesses and people. Their financial situation could suffer if they are unable to effectively handle the risks and uncertainties associated with any of these elements.

Bottom Line

I don't see even a single positive that will make me want to invest in it right now. However, a positive sales growth in these tough market conditions was appreciable. But I would advise to avoid it as the coming quarters might be volatile for the company in terms of financials. In addition, its valuation seems high, and the price action indicates a slight correction. Hence, I assign a hold rating on SHW.

"avoid it" - Google News

November 01, 2023 at 01:36AM

https://ift.tt/KlDNnOA

Sherwin-Williams Stock: Avoid It For Now (NYSE:SHW) - Seeking Alpha

"avoid it" - Google News

https://ift.tt/jhmdIEC

https://ift.tt/yJsgdwh

No comments:

Post a Comment