alvarez/E+ via Getty Images

SiteOne Landscape Supply (NYSE:SITE) distributes landscape supplies in North America. SITE recently posted its quarterly results, and its margins were under pressure and might continue to. The near-term outlook for SITE doesn’t look that good, and it is trading at a high valuation. So, considering these factors, I assign a hold rating on SITE.

Financial Analysis

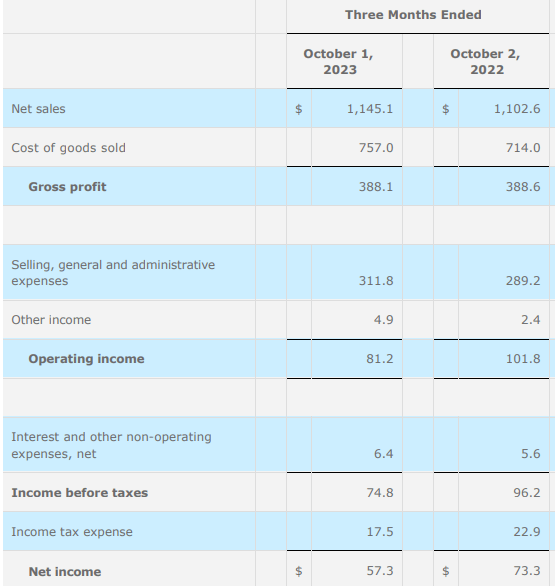

SITE recently posted its Q3 FY23 results. The net sales for Q3 FY23 were $1.1 billion, a rise of 3.8% compared to Q3 FY22. The increase was mainly due to the decent market demand, which increased the volume growth by 2%, and the other major reason behind the rise was its acquisitions, which contributed 6% to sales growth. The gross margin for Q3 FY23 was 33.9%, which was 35.2% in Q3 FY22. The drop in margin was mainly due to the commodity deflation. The company faced commodity deflation for products like PVC pipe and fertilizer, so they couldn’t enjoy higher pricing, which contracted the margins.

SITE's Investor Relations

Its net income for Q3 FY23 was $57.3 million, a decline of 21.8% compared to Q3 FY22. Increased expenses due to the acquisitions and lower margins affected its profitability in this quarter. It has acquired 90 businesses since 2014, and in Q3 FY23, it has completed six acquisitions. Growing its geographical presence through acquisitions has been its major strategy. It has proven beneficial for the company, and it was one of the major reasons behind its sales growth in tough market conditions. However, the acquisition strategy cannot fully tackle the adverse market conditions. The current market conditions aren’t favorable, which is why the sales growth was modest. Currently, it is facing commodity price deflation headwinds in products like fertilizer and PVC pipe. The company enjoyed strong margins in 2021 and 2022 due to strong price gains, but due to the deflation, its margins are adversely affected and will continue to be until the situation is normal. The deflation is expected to affect them till the first half of 2024, so for me, the near-term outlook for SITE isn’t positive, and its sales and margins might be under pressure in the coming quarters.

Technical Analysis

Trading View

SITE is trading at $137.1. The last six weekly candles of SITE have been red, which shows a selling pressure in the stock. After falling for six straight weeks, the stock took support from the trendline, which it has been following since 2020. Now, the stock is around its 200 ema, which is at $137.5 and has started showing signs of weakness. We can see a wick forming in the most recent weekly candle, which indicates selling pressure. I believe the stock might face resistance from its 200 ema in the coming times, and the stock price might consolidate around 200 ema until there is a huge buying in the stock. But for now, looking at the bearish price action, I would recommend avoiding SITE until we see any signs of a bullish reversal.

Should One Invest In SITE?

Its margins are under pressure, and the sales growth is modest. Its growth might remain modest, and the margins might remain under pressure in the coming quarters due to commodity deflation. But despite the modest growth, SITE is trading at a higher multiple, which makes it overvalued, in my opinion. SITE has a P/E [FWD] ratio of 33.2x, and the sector median is around 17.1x. SITE has an EV / EBITDA [FWD] ratio of 17.37x compared to the sector median of 10.97x. The modest growth and the negative outlook don’t justify its high valuation. So, looking at the adverse market conditions and high valuation, I think SITE might not be a great buy right now. Hence, I assign a hold rating on SITE.

Risk

SITE buys and sells a wide range of goods, some of which may have big and sudden price spikes, particularly during severe inflation and price and availability fluctuations. For instance, many of their contracts with suppliers contain prices for non-fixed or index-linked commodities, including chemicals used in fertilizer and grass seed, allowing their suppliers to adjust the cost of their goods in response to changes in the price of their inputs. On the other hand, in a deflationary economy, they might see a decrease in Net sales. These variations affect their company, as do their expenses for distribution and transportation. Variations in the prices of the goods they buy have an impact on their working capital needs, debt levels, financing expenses, net sales, and cost of goods sold. In periods of significant price volatility, they may not always be able to reflect increases in their expenses in their own pricing. Any incapacity to pass cost increases on to clients could have a negative impact on their operations, financial situation, and business. Additionally, they may experience lower profitability levels from selling such products and lower revenues from sales of existing inventory of such products if market prices for the things they offer decrease.

Bottom Line

SITE enjoyed strong margins in 2021 and 2022, which it won’t be able to anymore because of the commodity price deflation. The management’s acquisition strategy has benefited them, and the sales growth has been positive, but it isn’t significant, which can justify its high valuation. Hence, I think staying away from it might be a good idea. Looking at the outlook and its valuation, I assign a hold rating on SITE.

"avoid it" - Google News

November 19, 2023 at 08:34PM

https://ift.tt/M6vQnSi

SiteOne Landscape Supply: It Is Better To Avoid It (NYSE:SITE) - Seeking Alpha

"avoid it" - Google News

https://ift.tt/qs5u7HC

https://ift.tt/qZHj4YM

No comments:

Post a Comment