ragamnyakabar.blogspot.com

Ruth Saldanha: Tesla falls short after price cuts, Netflix posted stellar results, but we think its tailwinds should subside soon. And we have five scary stocks for you to avoid this Halloween. This is Investing Insights.

Welcome to Investing Insights. I’m your host, Ruth Saldanha. Let’s get started with a look at your Morningstar headlines.

Tesla’s Q3 Took a Hit

Tesla’s TSLA price cuts weighed on its third-quarter financial results. The electric vehicle maker’s operating income fell more than 50% compared to the same quarter last year, despite a 9% year-over-year uptick in revenue growth. Morningstar’s annual forecast had factored in price cuts weighing on profits and margins. Our analyst has trimmed his near-term forecast, however, to account for fourth-quarter price cuts and lower margins in 2024 as Tesla picks up its Cybertruck production. Tesla plans to start Cybertruck deliveries at the end of November. Morningstar expects the light-duty truck expenses will temporarily affect automotive profit margins through 2024. This is the same thing that happened in the Model 3 ramp-up. As production scales, however, the truck should become profitable. Morningstar is lowering its estimate of Tesla’s stock worth to $210 per share, down from $215 a share.

Netflix’s Strong Subscriber Growth

Netflix’s NFLX subscriber growth jumped in the third quarter. The streaming giant added nearly 9 million subscribers. That’s the company’s best showing since 2020′s second quarter, which was during the pandemic lockdowns. New sign-ups pushed up total revenue 8% year over year. Netflix is also expecting a strong showing in the fourth quarter. Meanwhile, it’s gearing up for price hikes in the U.S. and other major markets. This firm is still building out its ad infrastructure, including targeting and measurement capabilities. That should eventually drive much higher revenue from subscribers with ad-supported plans. However, Morningstar expects the ad improvements will raise costs. And Netflix will probably need to spend more on content next year as a result of the writers’ and actors’ strikes. Morningstar is raising its estimate for what Netflix’s stock is worth to $350 from $330 per share.

United Airlines Predicts Airline Industry Changes

United Airlines’ UAL third-quarter capacity and revenue results aligned with Morningstar’s expectations. However, the airline’s higher costs have once again exceeded predictions. Morningstar sees a scenario unfolding that may help United and other full-service carriers. They can defray their costs across different types of travelers. But no-frills airlines have had nowhere to hide from rising expenses like this past summer’s fuel price spikes and the leveling of domestic demand. United Airlines CEO Scott Kirby says that a shakeout is coming in the domestic market in 2024. He predicts at least one low-cost airline will fail as higher expenses bring their costs closer to their full-service rivals’, and he contends United is well-positioned to eventually benefit. United will get hundreds of new planes in the coming year. They’ll offer more premium seats and regular ones to pick off customers from struggling lower-cost carriers. Morningstar believes this is a plausible scenario but one that will weigh on the company’s margins. It is maintaining its fair value estimate of United’s stock at $35 a share.

5 Scary Stocks

Halloween is coming, and Morningstar has uncovered five stocks that investors should be afraid to invest in right now. These specters can be found across sectors—from education to telecom, from tech to logistics. Dave Sekera, the chief U.S. market strategist for Morningstar Research Services, is here to tell us more. Dave, thanks so much for being here today.

Dave Sekera: Of course. Good to see you, Ruth.

What Makes These Stocks So Scary?

Saldanha: Before we get into what the stocks actually are, tell us why you picked these stocks. What makes them so scary?

Sekera: It’s a combination of different factors that I looked for these stocks, and so I used a couple of different Morningstar tools in order to sort for the following characteristics. First I looked for those stocks that we rate with either 1 or 2 stars, meaning that we think that those stocks are trading significantly above their intrinsic value. Then I also look for those companies that we rate with not having an economic moat, so companies that we don’t think have long-term durable competitive advantages. And then lastly, I look for those stocks that we rate with either a High or a Very High Uncertainty Rating. Then once I had that, I did a little bit of a qualitative overview. I looked for those situations that I think have poor risk/reward scenarios, specifically instances where I think there’s a potential that these stocks could gap down very quickly upon certain catalysts.

What If You Own Scary Stocks

Saldanha: So, now we know what investors should do to avoid these stocks, but what should investors do if they already own the stocks?

Sekera: It always depends on your own personal investment portfolio strategy, but considering that all of these are going to be rated 1 or 2 stars, I do think investors should consider selling some of these stocks or at least begin to pare down their exposure. Now, depending on your portfolio construction and your investment strategy, I would then think that you can go and look to reinvest those proceeds and look for a couple of different characteristics. First, you can look for stocks of companies in the same or similar sectors. You can keep your portfolio weightings the same. Then I’d also look for stocks that are undervalued, those that we rate either 4 or 5 stars, look for companies with a wide or narrow economic moat. And then lastly, those companies that we rate with either a Low or Medium Uncertainty.

The Year of Tech

Saldanha: Let’s get into some of the stocks themselves. 2023 has arguably been the year of tech, and tech firm Dell DELL has made your list. Tell us about that.

Sekera: So right now Dell is rated 2 stars, trades at over a 40% premium to our fair value. We do rate the company no-moat, and it is a High Uncertainty stock as well. I think most people know Dell. I mean they sell PCs, displays, servers, and external storage, but that stock has risen over 60% thus far this year. In our opinion, we think the rally has outpaced the fundamentals. And I spoke to our analyst here and he suspects that this rally’s really due to an overexuberance on artificial intelligence here as well as the market’s expectations over the near term that we might see a rebound in the PC market.

But longer term, when I look at our forecast, we’re only projecting modest top-line growth in the medium to long term. And we see little opportunity here for material durable margin expansions. So for investors that are still looking for that exposure in the technology sector, one stock I would highlight is Advanced Micro Devices AMD. That’s currently a 4-star-rated stock, and it trades at over a 20% discount to our fair value. And it’s not only just a play on the recovery in the PC market, but we also do think it has some long-term potential to be the number-two player behind Nvidia NVDA, which is the number-one player in manufacturing those chips for artificial intelligence.

Supply Chain and XPO Stock

Saldanha: Another sector that we cover a fair bit is the supply chain, And freight and logistics company XPO XPO makes your list. Tell us a little bit more about that.

Sekera: Of course. XPO stock is currently rated 2 stars, and it trades at a 50% premium to our fair value. We also rate that company no-moat, and it has a High Uncertainty as well. For those of you who aren’t familiar, XPO provides trucking services and they really focus on what’s known as the less-than-truckload shipping sector. That stock is up 115% year to date. The reason there is that the market expects that XPO is going to benefit from the bankruptcy of its competitor Yellow Trucking, which filed earlier this year. And we agree it will certainly benefit from that. It will pick up some of that business. But I did speak with Matt Young, he’s the equity analyst who covers transportation and in this case XPO. Now, he thinks that investors right now are just over-extrapolating the benefits from the bankruptcy of Yellow, and he thinks they’re overestimating the long-term growth and profitability here. And considering how much and how quickly the stock has risen, if this company doesn’t meet these short-term expectations, I could easily see this stock gap down if this company misses.

And secondarily, I’m also just concerned that the trucking sector could be under pressure the next couple of quarters as the U.S. economy slows. Our economics team does think that the rate of economic growth is going to slow for the next three sequential quarters. I do think that’s a concern here as well. For investors looking for a swap idea in the transportation sector, I’d highlight Norfolk Southern NSC. That’s a 4-star-rated stock, trades at a 16% discount, and it currently yields 2.4%. That’s a company we do rate with a wide economic moat and a Medium Uncertainty Rating. And the wide moat here is going to be based on efficient scale and cost advantages. And lastly, the thing I would note here with Norfolk Southern is rarely do railroads ever trade much of a discount to our fair value. So, this is a rare opportunity today.

Advertising and Content Tech

Saldanha: Another tech name made the list and that’s Trade Desk TTD. Why did this advertising and content tech firm make the cut?

Sekera: Trade Desk is a 2-star-rated stock, and it trades over 50% premium to our fair value. Again, no moat, very high uncertainty. And for people who aren’t familiar, Trade Desk runs a platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory. So essentially it serves the buy side of digital ads, and it just trades very high multiples that we don’t think are necessarily warranted for this situation. So for example, it trades at 15 times 2024 revenue and 38 times our expectation for 2024 EBITDA. Unfortunately, we do think and expect that its growth rate is beginning to slow down, and we’re also concerned that the company’s take rate will begin to decline from competition. As such, with just these extraordinarily high valuations, any deviation at all from expectations really could send the stock down in a hurry. The swap idea I have here in the technology sector is for a smaller company called Tyler Technologies TYL. It’s a 4-star-rated stock that trades at a 23% discount. We rate the company with a wide economic moat and a Medium Uncertainty.

Education Sector in China

Saldanha: Let’s talk about the fourth stock, which is in education. The education sector in China has seen increased government regulations in the recent past. Chinese education company TAL Education TAL stock made the list. Tell us more about that.

Sekera: TAL right now is trading at a 70% premium to our intrinsic valuation. That puts it well into that 2-star category. And again, another company we don’t think they have an economic moat. And just because of the fundamentals here and the regulatory environment in China, it’s certainly a Very High Uncertainty Rating. And of course, Chinese companies are just going to be subject to the whims of the Chinese government. For example, in early 2021, the Chinese government decided it would not allow TAL to provide afterschool tutoring, which at that point in time was 90% of its business. At this point, the company does a couple of different things. They do enrichment learning, which are nonacademic programs, and they also have a business-oriented and enterprise-grade technology products and solutions for educational institutions.

Now, when we look at our valuation here, our intrinsic value for the company is $3.5 billion, and that’s comprised mostly of the amount of cash on the balance sheet, which is $3.3 billion. But, unfortunately, we project that they’re going to be free cash flow negative over the next three years, and we don’t forecast that they’re going to turn cash flow positive until fiscal 2027. So, that cash that the current valuation is based on will dwindle over the next three years or so before it could potentially turn around. So for investors that are looking for a company in China, one that’s going to be leveraged to the Chinese consumer, I would highlight Yum China YUMC. It’s a 5-star-rated stock, it’s a 39% discount to our fair value, and another company that we do rate with a wide economic moat and a Medium Uncertainty.

The Most Overvalued Stock

Saldanha: Which brings us to the last and scariest stock on the list, United States Cellular USM. Why is this the scariest stock you’d like to highlight today?

Sekera: United States Cellular is the most overvalued stock across our U.S. coverage right now. It’s a 1-star-rated stock, trades at about a 74% premium over our fair value, no economic moat, High Uncertainty. What this company is it’s a regional wireless carrier, and we think that by itself it’s just too small to be able to effectively compete against the giants like AT&T T and Verizon VZ. In fact, I spoke to our equity analyst here and his belief is that every day that this company operates as a standalone, it actually loses economic value. Now, in the past, the company has been unwilling to consider selling itself, but that changed in August when the company did announce that it’s considering strategic options, and the stock has more than doubled since then.

So if the company is able to sell itself, we do see some value in the company’s assets, and there might still be a little bit of a premium left here, but if it ends this process, and through these strategic alternatives either just doesn’t sell itself or maybe it only looks to sell some pieces of the business, I think that investors would be very disappointed and we could see the stock just drop like a rock thereafter.

In this case, I think the upside is probably pretty limited, whereas I think the downside is a long way to go down to where the stock was trading out prior to the announcement that they were looking at strategic alternatives. So, for investors, I think an appropriate swap here would be either for AT&T or Verizon. Both of those stocks are rated 5 stars. They trade at very deep discounts to fair value, and their dividend yields are over 7%.

How Often Investors Should Check on Stocks in Their Portfolios

Saldanha: Well, thanks for sharing those stocks, but now that we know this, how often should an investor look at their portfolio to make sure that their stocks aren’t about to enter the scary territory?

Sekera: Well, as we’ve seen with several of these stocks, stock prices can move very quickly when there is a catalyst, and I think this is a good reason that when you first buy a stock, you should set target prices both to the upside and to the downside. That way when a stock starts moving up, you might have an alert set up and you can take a look at it and then consider whether or not you should be selling some of that stock when it’s moved up, or conversely, when that stock moves down, whether you should be buying more of that stock when it comes down. Of course, when it hits those targets, you also really need to look and see if there’s any changes to your investment thesis in your valuation at that point in time.

You can use several different Morningstar tools. You can set up your individual portfolios of those stocks either you’re already invested in or that you want to watch those going forward. And you can also use our star rating system. Again, that’s going to tell you when we think a stock is starting to get too high above our intrinsic valuation, it starts moving into a 2-star territory or even a 1-star territory. And then to the downside, if that stock is falling and we think that there’s becoming a greater margin of safety and our investment thesis hasn’t changed, then it starts going into those 4- and 5-star-rating territories, which we think are good opportunities for investors then to start putting money to work.

And then lastly, when a stock is trading in that 3-star territory, a lot of people don’t necessarily understand what a 3-star stock is. What that means is that we think that it’s within the range that we consider that stock to be fairly valued. And for 3-star-rated stocks, we expect that long-term investors will end up earning the company’s cost of equity over time.

Saldanha: Great. Thank you so much for joining us today, Dave.

Sekera: Of course. Thank you, Ruth.

What’s Going on in the Banking Sector?

Saldanha: It’s only been a couple of quarters since three bank failures pressured the U.S. industry. Some banks are seeing record profits while others are working to regain their footing. Eric Compton covers banks as an equities strategist for Morningstar Research Services. He spoke to Morningstar’s senior multimedia editor Ivanna Hampton about the sector. Here’s what he had to say.

Ivanna Hampton: Thanks for joining me, Eric.

Eric Compton: It’s great to be here.

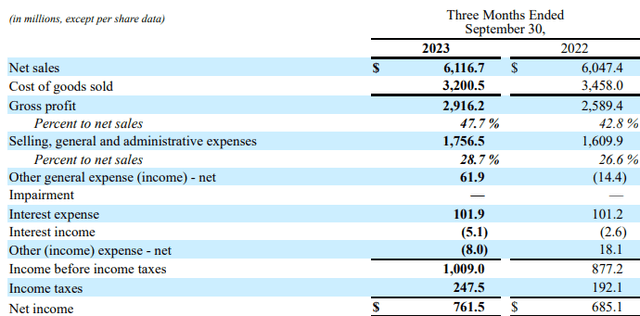

Hampton: The banks have reported their third-quarter earnings. Let’s start with the big banks. What were the key takeaways?

Compton: The big banks are doing pretty good, actually. Not the case for some of the other banks, which we’ll get to next. But big banks are doing great. All banks, the Big Four, JPMorgan JPM, Bank of America BAC, Citigroup C, and Wells Fargo WFC, they were all able to either beat in the current quarter on net interest income and/or raise their net-interest-income guidance. So, that’s a big concern for the sector right now is the strength of that revenue item. They’re doing great there. They’re not seeing the same profitability pressure as some of the other banks. You’re still seeing some deposit outflows, you’re still seeing increases in funding costs. But so far they’re able to handle it pretty well. I would say generally good results for the big banks on the revenue side.

Credit, not much movement this quarter. A little bit of movement in some of the nonperforming loans or some of the criticized assets for commercial real estate lending. But not much movement in provisioning, not much movement in macro assumptions. The balance-sheet growth is slowing down a bit, which was expected. Banks are generally reigning in some of their credit right now, increasing some of the standards. They want to manage risk in the current environment. So, overall profitability holding up well, balance-sheet growth slowing down a bit, credit—not much movement. So, really not a bad quarter for the big banks at all.

Hampton: Now the regional banks, a pattern emerged among those. They’re dealing with higher funding costs. Describe what’s going on there and the impact.

Compton: The regional banks are facing a bit more pressure than the larger banks. So, there are more question marks around how they’re going to be doing. We got some more information this quarter. Funding costs are going up. They’re going up for the big banks and the regionals, but they’re going up at an even more accelerated pace for the regionals compared to the big banks.

One way to describe that, in bank land we call that a deposit beta, which basically just measures how fast deposit costs are going up relative to a base rate like the federal-funds rate. So, deposit betas are higher for the regionals. They’re generally hitting 120% or more, meaning that costs on those deposits are going up even faster than base rates currently. Larger banks are closer to 100%. So, regionals are facing more pressure on the funding side.

Also seeing some deposit outflows and seeing some continued shifts into the interest-bearing deposits from the non-interest-bearing, which also increases funding costs. For them, noninterest income is under a little bit more pressure. There’s some question marks for them about when will we see a bottom, when will we get better visibility around that? Some are doing better than others, but for the regionals, we’re still at the point where funding costs continue to go up. Net interest income generally going down, still, quarter over quarter for most of them. We still aren’t quite sure yet when exactly that pressure will reach an equilibrium.

What Is Net Interest Income?

Hampton: Now you’ve mentioned net interest income. Can you explain what that is and what does it reveal about a bank’s health?

Compton: Absolutely. So net interest income, it’s definitely very much a banking concept. You don’t see that in other companies. So net interest income is, if you think of a bank, they’ve got two main items on their balance sheet, roughly speaking. Things they earn interest income on and things they pay interest expense on.

So, you think about we keep our money at the bank, that’s a deposit. If your bank is, I guess, treating you well, hopefully they’re paying you some interest on it, that’s an expense for them. Then if you take a loan out from the bank, you pay interest to the bank. So, net interest income is just you add up all the expenses they’re paying out, take all the income they’re earning on those assets, and the sum of that is their net interest income. It’s really important for the banks because it makes up a majority of their revenue. Regional banks often will get 70% even 80% of their revenue from net interest income. So very important line item.

It’s even more, I could say, under scrutiny in today’s environment because of the funding cost dynamics where those interest expenses are going up quite a bit. That’s a higher expense level that eats into net interest income, decreases banking profitability. So, under a lot of scrutiny these days. I’d say the big controversy is, especially for these regionals, the net interest income has generally trended down for the last several quarters. Funding costs keep going up, they’re going up maybe a little bit less, in an absolute sense than they were before, but they’re still going up. We haven’t quite reached that equilibrium yet.

A big question is when will we reach the equilibrium? When will this net interest income—this line item that’s so important for bank profitability,—when will that eventually reach a plateau, or I should say like a bottom, actually. When will it bottom out? Then from there, we’ll have a much better sense of what the profitability profile of these banks will look like in this current interest-rate cycle.

Regulatory Risk and Interest-Rate Risk

Hampton: Wow. That is something to pay attention to. So you’ve recently published a deep dive about regulatory risk and interest-rate risk. Can you sum up the key takeaways and what does it mean for the sector?

Compton: Absolutely. We covered a little bit of the interest-rate risk. One of the key risks right now is every time the Federal Reserve hikes the federal-funds rate, interest rates go higher, and those deposit costs go up even more. Right now, like we talked about, the funding costs are generally repricing a bit faster than what the assets are repricing at. So, one key risk is if the Fed decides it needs to keep hiking, that’s going to put even more pressure on the banking sector, more pressure on net interest income, more pressure on profitability. That’s one of the risks we’re keeping a close eye on.

Based on our research, based on that report, one of the key takeaways was we think we still have a couple more hikes before we’d really start to worry. But two, three, four more hikes from here, we think it could really start to put some other regionals under pressure in a way where things would start to get a little more dicey. So, that’s one risk to definitely keep an eye on.

Another risk related to interest rates is a little more complicated, you could say. But essentially, as longer-term interest rates go up, banks have these fixed-rate assets on their balance sheet, primarily mortgage-backed securities. When rates go up, because that’s a fixed-rate asset, the market value of those assets go down. Now, the banks haven’t sold those, so it results in an unrealized loss. It does not realize until they sell it, so it’s not really impacting them, you could say, explicitly yet because it’s just sitting on the balance sheet. Eventually, it’ll mature. Once it matures, because it’s backed by the government, the bank will get all its money back, so it’ll be fine.

But in the interim, you have these unrealized losses piling up. These unrealized losses affect capital ratios for the largest banks. Because of changing regulations, will soon affect capital ratios for the smaller banks. So, every time longer-term rates go higher, the kind of bottom line is it extends that timeline that the smaller banks have to meet the updated regulatory requirements. It’s kind of a mouthful, kind of a long one, but basically higher long-term rates, it’s going to take the smaller banks longer to meet regulatory requirements is probably the easiest way to sum it up. That’s another one to keep an eye on.

To put another summary on that, the banks we cover, the ones that have pushed it out the farthest, we still think they’re going to meet these requirements by, call it like mid-2025. The regulations don’t come into full force until mid-2028, so they’ve still got plenty of wiggle room. But as longer-term rates, if they keep going up, that wiggle room gets less and less. So, another one to keep an eye on.

Bank Stock Picks

Hampton: All right. So name some of your top picks within the banking sector.

Compton: Absolutely. So, the one thing I always start out with when I tell clients is I do think the market is sorting risk pretty fairly right now. The banks that are the cheapest tend to have some of the higher risks associated with them. They’re under more pressure right now. The banks that are maybe not quite as cheap, it’s usually because they’re not in quite of a position as the banks that are cheaper. I think the market’s doing a fair job at sorting risk. In today’s environment, we generally get more requests for, “Can you highlight a lower-risk bank that still has some discount?” So, you try to get maybe the best of both worlds.

On that theme, a couple banks I like among the regionals, PNC PNC and M&T Bank MTB, the reason I like both of those is they’ve got less of that duration risk. So, those unrealized losses that we talk about, they have less of that going on. They don’t have as much pressure on the capital builds that they’ll have to do going forward. Because of the less duration risk, they’re also facing less pressure on net interest income profitability, so less rate sensitivity there as well. So, you combine less duration risk, less capital bill pressure, less sensitivity to the rates on profitability, I like how they’re positioned in today’s environment, and they still got a bit of a discount. We’ve got them at around 35% below our fair values today. So I like those two.

Then people always want one among the Big Four. Among the big four, I don’t think JPMorgan’s that cheap. It is the highest-quality, not that cheap. Bank of America has a pretty big unrealized loss position on its books, so if you’re looking to avoid that, Bank of America may not be your top pick. Then you’re kind of left with Citigroup and Wells, and I think Wells is further along in the turnaround process. They also don’t have quite as much of some of the rate-sensitivity stuff because they weren’t able to build up the huge deposit base like some of the other banks were. So, a little bit less of that deposit flight risk going on. I like how they’re positioned among the Big Four with kind of riffing on that theme.

Hampton: All right. Well, Eric, thank you for your time today.

Compton: Absolutely. Great to be here.

Saldanha: Thank you, Eric and Ivanna! That’s all for this week’s episode. Don’t forget to subscribe to Morningstar’s YouTube channel to see new videos about market news, personal finance, and investment picks. Thanks to podcast producer Jake Vankersen who puts this show together. I’m Ruth Saldanha, an editorial manager at Morningstar. Thank you for tuning into “Investing Insights.”

Read About Topics From This Episode

Tesla Earnings: Price Cuts Weigh on Margins While Cybertruck Launch Officially Scheduled

Netflix Earnings: Stellar Results Show Durable Strengths but Also Some Tailwinds That Should Subside

2 Big Tech Stocks to Buy

Q4 Stock Market Outlook: Equities Undervalued After Retreat

What Rising Bond Yields Mean for Q3 Bank Earnings

Adblock test (Why?)

"avoid it" - Google News

October 27, 2023 at 11:43PM

https://ift.tt/AZBHFYj

5 Scary Stocks for You to Avoid This Halloween - Morningstar

"avoid it" - Google News

https://ift.tt/zXWuHJI

https://ift.tt/mYoi7xC