Indian IT stocks, which have contributed much to the market rally recently, are in no mood to take a breather. But is the recent strength in the rupee against the US dollar a warning sign for the IT basket?Strength in the rupee -- though a boon for importers such as oil companies -- affects the profitability of Indian IT and pharmaceutical companies, which derive the lion's share of their topline from foreign markets.

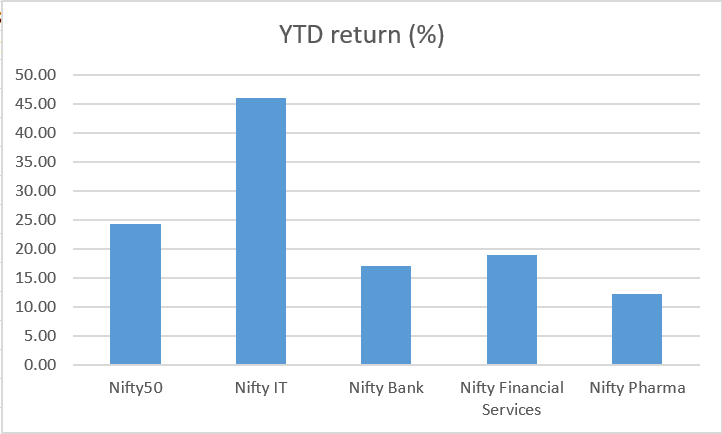

Nifty IT has outshined NSE's sectoral indices this year with a return of 46 percent.

Nifty IT has outshined NSE's sectoral indices this year with a return of 46 percent.| Stock | YTD Return (%) | Sept 7, 2021 | Dec 31, 2020 |

| MINDTREE | 129 | 3,804 | 1,660 |

| LTI | 48 | 5,414 | 3,660 |

| TCS | 34 | 3,824 | 2,863 |

| INFY | 36 | 1,708 | 1,256 |

| HCLTECH | 25 | 1,184 | 946 |

| TECHM | 48 | 1,438 | 973 |

| WIPRO | 75 | 675 | 386 |

| MPHASIS | 93 | 2,975 | 1,540 |

| OFSS | 47 | 4,735 | 3,213 |

| COFORGE | 91 | 5,166 | 2,705 |

Meanwhile, the rupee has recovered nearly all of its losses in 2021. It has moved within a tight range since hitting a two-month high against the greenback recently. However, its gains might be short-lived.

Continuous foreign fund inflow has helped the rupee gain strength. That while dovish comments from the Federal Reserve Chairman sent the dollar to a two-week low, aiding the rupee."Renewed portfolio inflows, a strong buffer of forex reserves and the parabolic rise in domestic equities have underpinned the rupee to nudge higher towards a two-month high," Sugandha Sachdeva, VP-Commodity and Currency Research at Religare Broking, told CNBCTV18.com.The US central bank is likely to remain accommodative amid a patchy US jobs market softening the dollar index, leading to an appreciation bias for the rupee. The rupee can strengthen a bit more against the greenback in the near term, but is "unlikely to breach the invincible 72.20 mark," she said.The impact of rupee strength is likely to be limited on IT and pharma companies, said Kapadia."Most of these companies have hedging strategies to mitigate high volatility. Companies with upright forex management policies can soften this effect, while others may be exposed to a marginal higher impact this in Q2," he said.Nonetheless, Kapadia said, the currency situation "may not pose a big influence on a long-term basis".Where is the rupee headed?Religare Securities' Sachdeva expects the domestic currency to once again lose ground and depreciate towards 76 by the end of 2021."The economic recovery from the pandemic induced lows is now showing signs of peaking out and is likely to act as a headwind for the rupee. Uncertainty around the timing of asset tapering and rising price pressures in the US would also have a bearing on the risk sentiment and the incessant flow of portfolio money, which will steer the path of the rupee," she added.How to play the export theme nowITDespite the medium-term currency concerns, Kapadia remains positive on pharma stocks. He likes Sun Pharma, Aurobindo Pharma and Dr Reddy's in the space.Nair recommends TCS, Infosys, HCL Tech and Mindtree from the IT pack. He expects strong order books and execution capabilities to drive their performance.Khemka likes Infosys and HCL Tech from the Tier I stable, and L&T Technology, Cyient and Zen Technologies among Tier-II players in the sector.PharmaFrom the universe of drugmakers, Nair's top picks are Divi's Labs, Torrent Pharma and Cadila Pharma. "Their robust pipeline, a favourable mix of generics and custom synthesis and incremental demand support top-line growth," he said.

"avoid it" - Google News

September 08, 2021 at 10:00AM

https://ift.tt/2X2oBLF

As rupee nearly recovers 2021's losses, time to avoid IT, pharma stocks now? - CNBCTV18

"avoid it" - Google News

https://ift.tt/3844a1y

https://ift.tt/2SzWv5y

No comments:

Post a Comment