As the COVID-19 pandemic continues to decimate many businesses across the nation, zombie companies have become a very popular topic of conversation. But to those who do not emerge in the financial world on a daily basis, this leaves one question. What is a zombie company?

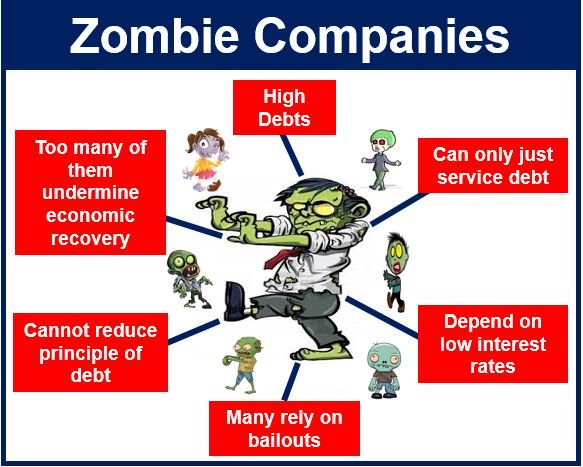

To put plainly, a zombie company is a company that is heavily indebted and only generates enough cash flow to cover the interest payments on their debts. Such a company does not generate enough to pay down the principal. This means they stay stagnant and unchanging since they do not have the excess cash to invest and grow.

Zombie companies are trading stocks in the U.S. stock markets

This has become a problem for many businesses, both public and private, that rely on easy, affordable access to credit. A 2013 study conducted by Deutsche Bank Securities showed about one in five publicly traded U.S. companies is a zombie. It is estimated that figure has doubled since and is well up from the 1990s when there were almost no zombies in the market place.

The COVID-19 pandemic has made creditors tighten their wallets, only giving loans to businesses that are in good financial standing, have maintained solid revenue streams, and unlikely to go bust. If creditors do offer loans to these zombie companies, it is usually at a high-interest rate. This high-interest rate reflects the risk the creditor is taking by loaning their cash to the zombie company.

Often times, zombie companies are also businesses that encounter decreased revenues in a time of economic distress. This makes it harder for them to generate the capital needed to continue paying the interest payments keeping them afloat. Between losing access to affordable capital, and declining revenues, zombie companies begin to collapse in poor economic environments.

An obstacle to economic growth

Zombie companies are often seen as an obstacle to economic growth. Their inability to grow detracts from overall productivity. Economists argue zombies eat up market share and keep talent from successfully operating companies. Without the cash needed to invest and grow, zombie companies are inefficient and uncompetitive, lowering productivity in the global economy.

Due to the global pandemic, we are seeing zombie companies do play a very important role in the overall health of the economy. For example, a zombie company that employs a large number of people may receive a government bailout in order to avoid massive job losses that have a huge societal impact.

During the current pandemic, we are not seeing these bailouts from the government or private creditors. This has resulted in job loss rates reaching all-time highs as more and more zombies collapse.

—————————————-

Have a story you want USA Herald to cover? Submit a tip here and if we think it’s newsworthy, we’ll follow up on it.

Want a guaranteed coverage? We also offer contract journalism here. We practice journalism ethics and standards. We strive to present news stories with accuracy, fairness, impartiality, integrity, truthfulness, and public accountability.

Want to contribute a story? We also accept article submissions — check out our writer’s guidelines here.

"avoid it" - Google News

September 29, 2020 at 10:09PM

https://ift.tt/3jacPoO

What Is A Zombie Company And Why You Need To Avoid It - USA Herald

"avoid it" - Google News

https://ift.tt/3844a1y

https://ift.tt/2SzWv5y

No comments:

Post a Comment